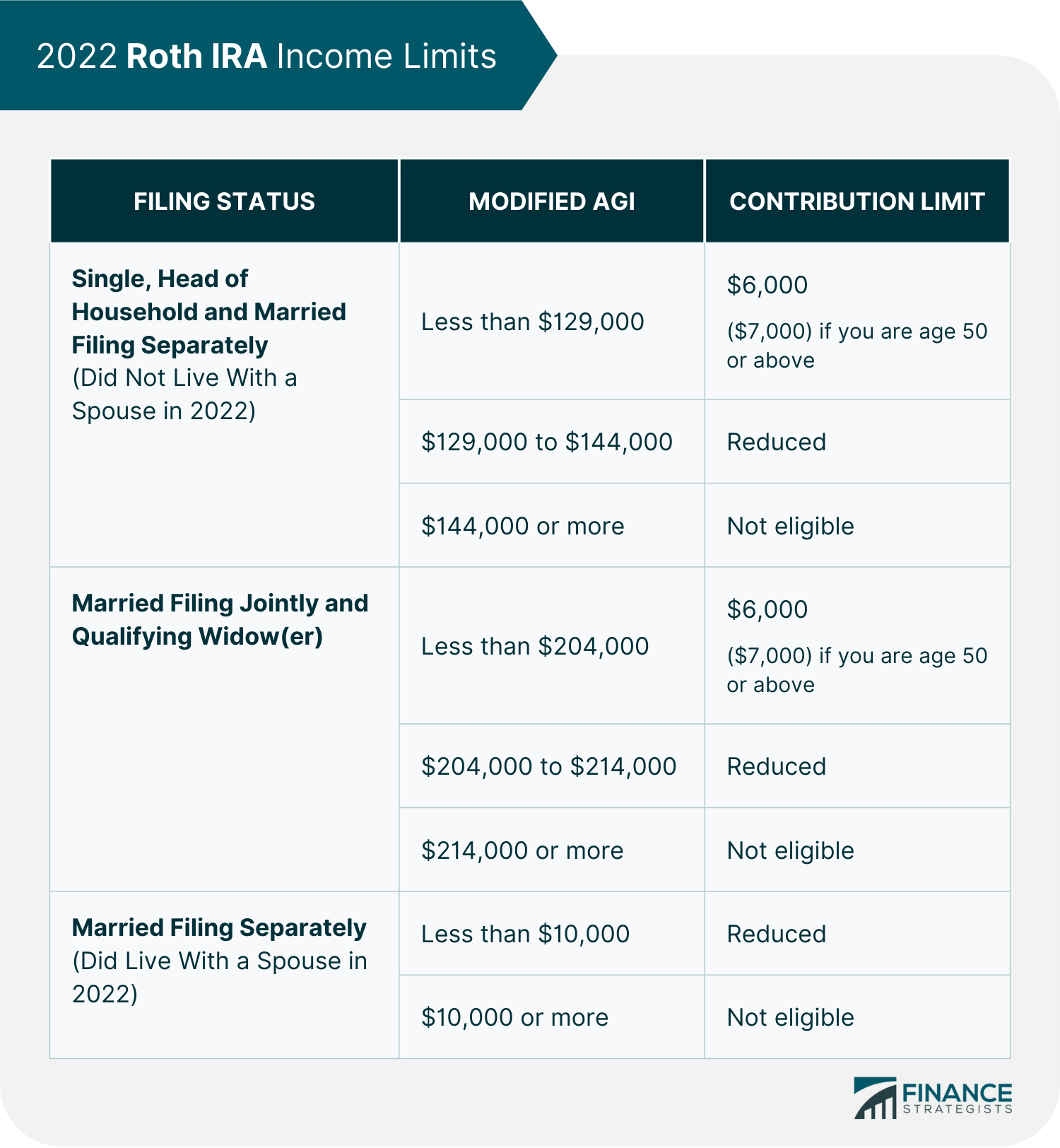

Ira Limits 2025 Income - IRS Unveils Increased 2025 IRA Contribution Limits, The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. Anyone can contribute to a traditional ira, but your ability to deduct contributions is based on your. Year End Look At Ira Amounts Limits And Deadlines, Information about ira contribution limits. The 2025 roth ira income limits are less than $161,000 for single tax filers and less than $240,000 for those married filing jointly.

IRS Unveils Increased 2025 IRA Contribution Limits, The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. Anyone can contribute to a traditional ira, but your ability to deduct contributions is based on your.

Simple Ira Contribution Limits 2025 Irs Elisha Chelsea, It might make more sense to convert only enough ira funds to bring your income up to the top of your current bracket. Find out if you can contribute and if you make too much money for a tax deduction.

2025 ira contribution limits Inflation Protection, The maximum amount you can contribute to a roth ira in 2023 is $6,500, or $7,500 if you’re age 50, or older. 2025 roth ira contribution limits and income limits the maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2023) if you're.

Ira Limits 2025 Income. 12 rows if you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2023 and $161,000 for tax year 2025 to contribute. Find out if you can contribute and if you make too much money for a tax deduction.

Limits For Roth Ira Contributions 2025 Gnni Shauna, The 2025 roth ira income limits are less than $161,000 for single tax filers and less than $240,000 for those married filing jointly. The roth ira contribution limits are $7,000, or $8,000 if.

Nail Designs 2025 Coffin. Then, this post gives you popular coffin nail designs, from minimal to absolutely extra. Want to try round & square coffin […]

Ira Limits 2025 For Conversion Clarey Lebbie, If you are 50 and older, you can contribute an additional $1,000 for a total of $8,000. But each year, the irs adjusts the rules for ira eligibility based on inflation.

Roth Ira Limits 2025 Married Filing Jointly Karla Marline, $6,500 (for 2023) and $7,000 (for 2025) if you're under age 50. The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

The irs announced the 2025 ira contribution limits on november 1, 2023.

2025 Prime Day Deals. Get shopping tips and details to save big on popular brands like clinique, allbirds, sony, kitchenaid, and more. Amazon prime day […]

Roth Ira Contribution Limits 2025 Capital Gains 2025 Taryn, Roth ira income limit for 2025. A roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira.